Donald Trump has said he is serious about eliminating the federal income tax if he wins the race for the White House.

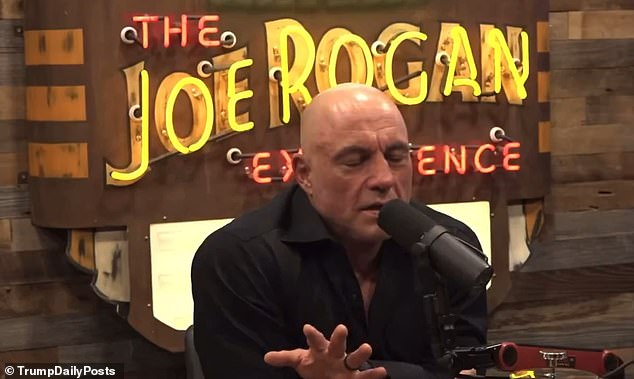

Speak with comedian Joe Rogan on his hugely popular podcast On Friday, Trump proposed a return to tariffs on imports of foreign goods.

He was referring to President William McKinley who, when in power in 1890, raised tariffs to nearly 50 percent.

Rogan, 57, asked the Republican candidate: “Did you just propose the idea of abolishing income taxes and replacing them with tariffs? Did they mean that?’

He replied: ‘Why not, our country was the richest in the 1880s and 1890s, a president who was assassinated called [William] McKinley, he was the rate king. He spoke beautifully about rates, his language was really beautiful.’

Trump was referring to President William McKinley who, when in power in 1890, raised tariffs to nearly 50 percent.

Rogan had asked the presidential candidate if he meant it when he talked about cutting federal income taxes

“We will not allow the enemy to come in and take our jobs, take our factories, take our workers and take our families unless they pay a high price. The big price is the rates.’

Trump has repeatedly talked about his plans to impose tariffs of up to 60 percent on imported goods, especially those coming from China.

When Trump appeared at a barbershop in the Bronx on Monday, he was asked whether the US could end all federal taxes.

Once again he raised the idea that he would return to President McKinley’s economic policies.

He said: ‘It had all the rates. there was no income tax. Now we have income taxes and people are dying.

“They pay taxes, but they don’t have the money to pay the taxes.”

Trump has yet to provide more details on how he thinks that idea would work; it is unclear whether he would also drop corporate tax and payroll tax.

He had repeatedly denied that average Americans would bear the brunt of the costs of tariffs, arguing that companies abroad would pay them.

Despite his claims, the Center for American Progress Action Fund found that a 10 percent rate would amount to an annual tax increase of roughly $1,500 for the typical American household.

Trump has repeatedly talked about his plans to impose tariffs as high as 60 percent on imported goods, especially those coming from China.

A report earlier this year said aggressive tariffs are more likely to harm than help working Americans

It would include a $90 tax increase on food, a $90 tax increase on prescription drugs and a $120 tax increase on oil and petroleum products.

The study found that while tax increases would raise the price of goods, they would fail to significantly boost U.S. production and employment.

It estimates that Americans will import $3.2 trillion in goods next year, so a 10 percent tariff would effectively increase taxes on goods by about $300 billion.

That would average $1,700 per household in the first year. But when looking at middle-income households, which consume about 85 percent as much as the average household, according to Consumer Expenditure Surveys, this suggests a tax increase of roughly $1,500 for the average household.

For food, the rates would amount to a $90 tax increase, the analysis found. 60 percent of fresh fruit to the US is imported, as are 38 percent of fresh vegetables. 70 to 85 percent of seafood is imported. And less than 1 percent of coffee is produced in the United States.

A tariff would also raise prices in the long run as U.S. farmers face higher costs to get supplies from abroad.

On top of the increases for food, prescriptions and oil, it would include an $80 tax increase on electronics, $220 on cars, motorcycles and recreational boats, a $70 increase on clothing and a $50 increase on furniture, kitchen appliances and other household items.

As part of his podcast appearance alongside Rogan, Trump also spoke generally about UFOs, the unopened assassination files of JFK and Martin Luther King, as well as his recent brush with death.