Average house prices rose by 2.8 per cent in the 12 months to August this year, according to the latest figures from the Office of National Statistics.

But that may not be the case where you live, as local real estate markets can perform very differently.

Estate agent Hamptons has analyzed ONS data and revealed that a market in the Midlands is the hottest in Britain in terms of house price growth over the past year.

House price winners and losers: North East Derbyshire and Monmouthshire have seen house prices rise by almost 10 per cent in the past year, while prices in Dover have fallen

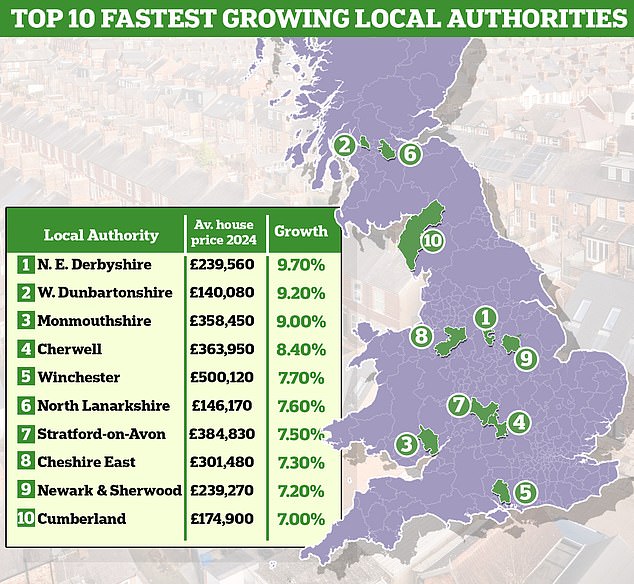

Homeowners in North East Derbyshire have seen prices rise the most, with a 9.7 per cent increase in the year to August.

The typical property in the rural district, which includes towns on the outskirts of Chesterfield such as Dronfield and Clay Cross, is now selling for £239,560, up from £218,340.

The area is perfect for those looking for more rural living, but also offers short commuting distances to cities such as Sheffield, Derby and Nottingham.

West Dunbartonshire in Scotland is the next best performing local authority, with average house prices there rising by 9.2 per cent.

The typical property now sells for £140,080, up from £128,278 a year earlier.

The area includes part of the Loch Lomond & The Trossachs National Park, but is also within traveling distance of Glasgow city centre.

Aneisha Beveridge, head of research at Hamptons, says areas on the outskirts of cities have benefited most from house price growth this year.

Top assets: House prices rose the most in these ten areas in the year to August

“As mortgage rates have fallen, buyers who remain priced out of cities have increasingly sought out slightly cheaper areas on the outskirts,” says Beveridge.

‘These movements are driven by first-time and second-time buyers, who found it difficult to buy when interest rates peaked last year.

‘With many of these younger generations working more from the office this year, they are keen to have the best of all worlds: affordable housing with city amenities close by.’

Monmouthshire in Wales has also seen a dramatic increase in house prices, with the average home there rising by 9 per cent year-on-year from £328,853 to £358,450.

Verona Frankish, director of property website Yopa, puts this down to it being the location of two bridges connecting England and Wales.

“The property market in Monmouthshire is performing very strongly and there are two main reasons for this: the Prince of Wales Bridge and the Severn Bridge,” she says.

‘Monmouthshire is home to the best Wales has to offer: historic towns, vibrant culture and exceptional natural areas.

‘As a result, it offers an extremely high quality of life, but with the added bonus of quick and easy access to England and the rest of Wales, making it extremely popular with both Welsh and English buyers.

‘Therefore, those looking to buy in the area are in a much stronger financial position than most and this has enabled them to better weather the higher purchasing costs of recent times, which in turn has kept the Monmouthshire property market buoyant.’

Where have house prices fallen?

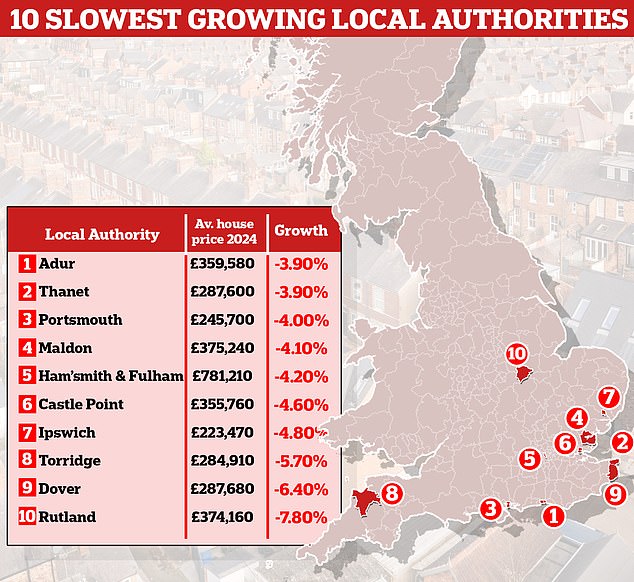

Coastal areas in southern England have seen some of the biggest falls in property prices in the year to August, according to research from Hamptons.

Eight of the ten areas where the largest price falls have been recorded over the past year are on the coast.

Says Beveridge: ‘Cities along the south coast – popular during the Covid years – have seen price falls after a few years of strong growth.’

This includes Adur in West Sussex, Thanet in Kent and Portsmouth in Hampshire.

Sea Change: Coastal cities saw some of the biggest home price declines last year

However, prices in Rutland in the East Midlands saw the biggest fall, falling 7.8 per cent year-on-year from £405,750 to £374,160, wiping an average of £31,590 off the value of a typical house.

The small province has only one train station, which may have affected its popularity among commuters since the pandemic.

It’s a similar story for prices in Dover, where the average selling price has fallen by 6.4 per cent from £307,450 to £287,680. That equates to £19,770 which has wiped out the value of the average home.

Marc von Grundherr, director of Benham and Reeves estate agents, says the Dover property market has suffered for a number of reasons.

“The first reason is that the competition for coastal properties that arose during the pandemic has simply decreased,” says von Grundherr.

Expert: Marc Von Grundherr, director at real estate agency Benhams & Reeves

‘This has reduced the level of buyer demand for such locations, which in turn has caused house prices to cool.

According to Von Grundherr, Dover’s image has also suffered from illegal migration.

“We see headlines every week about the number of illegal migrants attempting to cross the Channel, with over 800 arrivals in the last week alone,” he added.

‘The Channel Crossing is the UK’s gateway to Europe and while it is not the only entry point for these migrants, it is becoming synonymous with the issue, which will always deter buyers.

‘It is also important to remember that, despite the sharp falls in property values, the average house in Dover is still just below the UK average.

‘So it’s certainly not an affordable part of the market, meaning buyers are likely to struggle with higher financing costs.’

Torridge in North West Devon has also seen house prices fall by 5.7 per cent – the equivalent of £17,200 from the average home in the district – according to Hamptons analysis.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.